SCR Calculator User Manual

Version 1.17 Last modified 2025-4-6

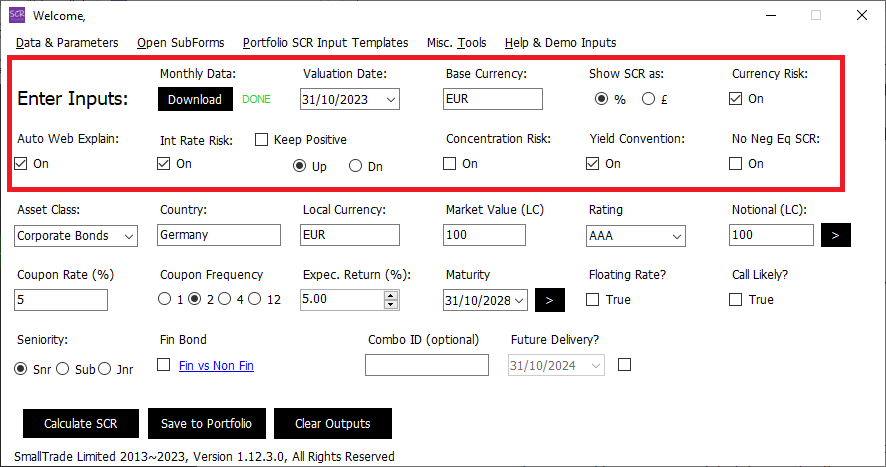

Settings

The first two rows of inputs, referred to as Settings, are crucial as they influence not only the single asset calculations but also all computations across functional forms:

-

Auto Web Explain

When enabled (default), this checkbox triggers API-based explanatory notes for single asset SCR calculations by transmitting parameters to the server. If disabled, no data is sent, and no notes are retrieved.

This setting affects only single asset calculations. Portfolio SCR calculations never transmit user data.

-

Monthly Data

Downloads the monthly dataset for the selected Valuation Date. It automatically updates at startup and will re-trigger if the Valuation Date changes.

-

Valuation Date

Typically set to the most recent past month-end date, with a slight delay of 3–5 days if at the start of a new month.

-

Base Currency

Refers to the portfolio's currency, distinct from the local or issuance currency of individual assets.

-

Show SCR as %/£

Toggles between displaying SCR figures as percentages or monetary amounts.

-

Currency Risk

Disabling this checkbox excludes currency risk SCR from calculations, useful when focusing on other SCR types.

-

Int Rate Risk

When unchecked, excludes interest rate risk SCR from calculations. Additional options include:

-

Keep Positive

Ensures the interest rate SCR is always positive, representing stress.

-

Up / Down

Specifies the direction for interest rate SCR calculations.

-

Keep Positive

-

Concentration Risk

Typically excluded from calculations.

-

Yield Convention

Refers to the bond yield methodology. For example, a 6% semi-annual coupon represents a 6.09% annualised compound yield.

-

No Neg EqSCR

Prevents equity SCR from being negative (e.g., for a short call) by forcing all equity SCR values to be positive.