SCR Calculator User Manual

Version 1.17 Last modified 2025-4-6

Reducing SCR While Enhancing Yield

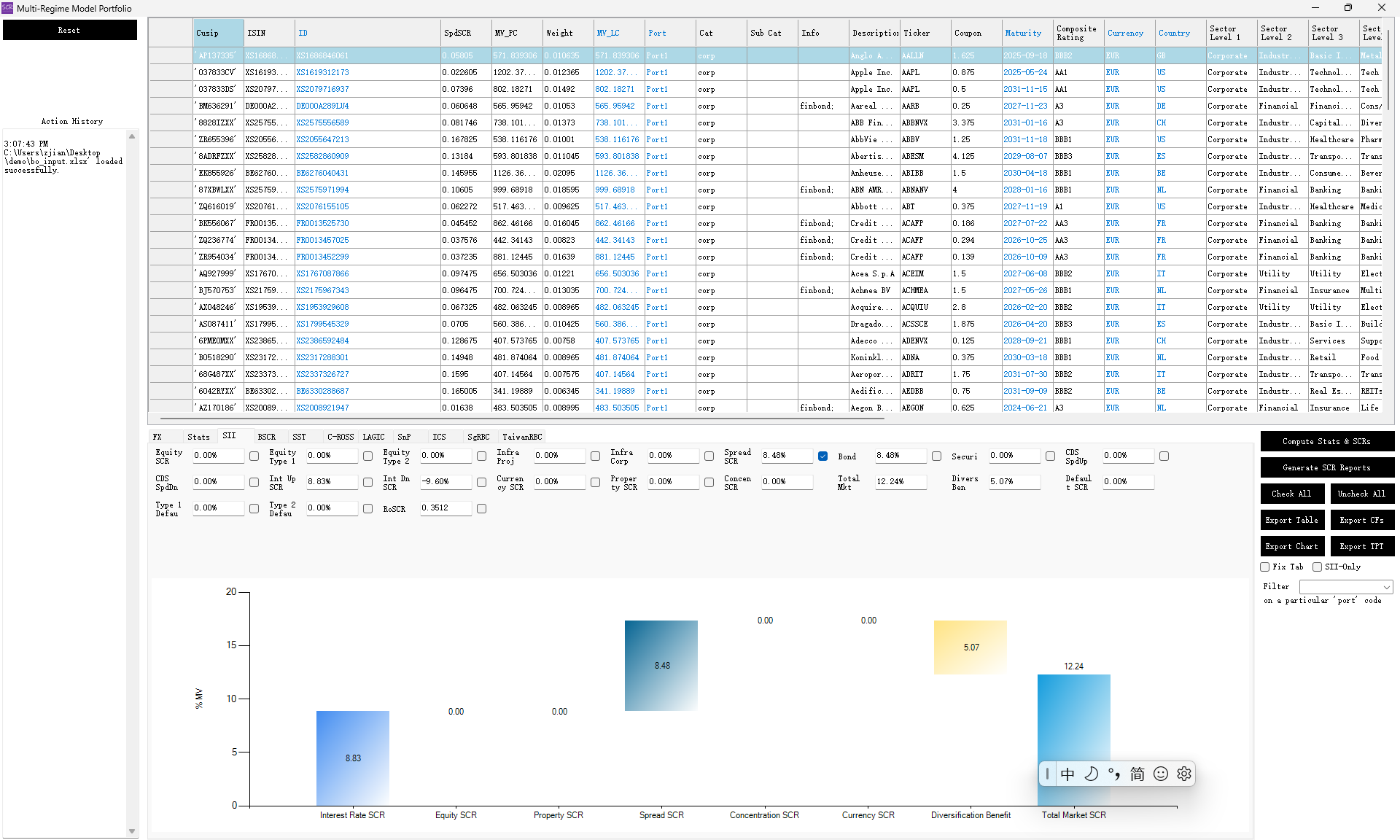

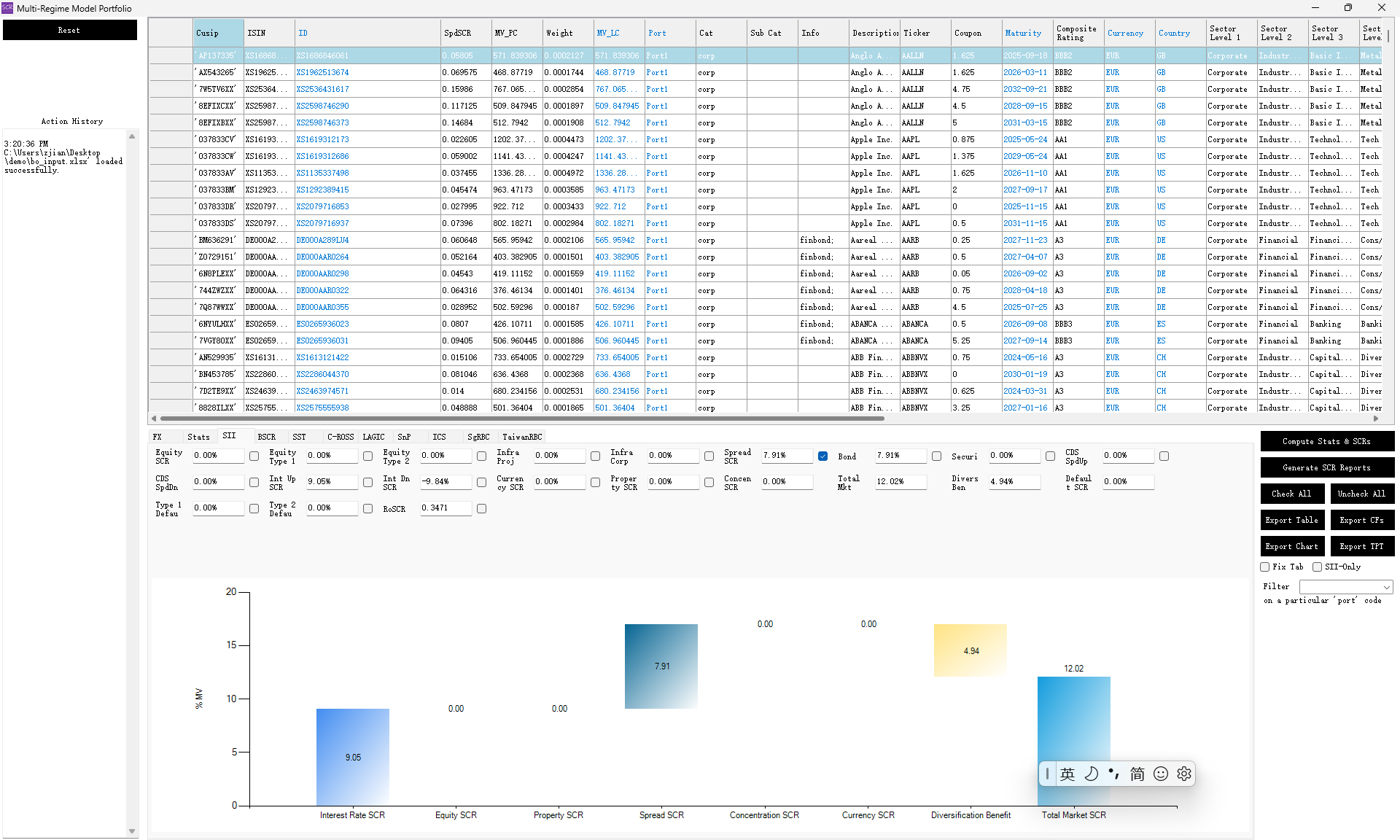

Calculating SCR Using the Portfolio SCR Form

The same Bloomberg inputsheet can be used in the Portfolio SCR Form to calculate SCR values. In this example, we calculate the Solvency II Spread SCR for both the 'Current' and 'New' tabs. Ensure the import format is set to 'Bloomberg.' Then, navigate to the "SII" tab and tick the checkbox next to "Spread SCR."

SCR for Current AssetsSCR for New Investible Assets

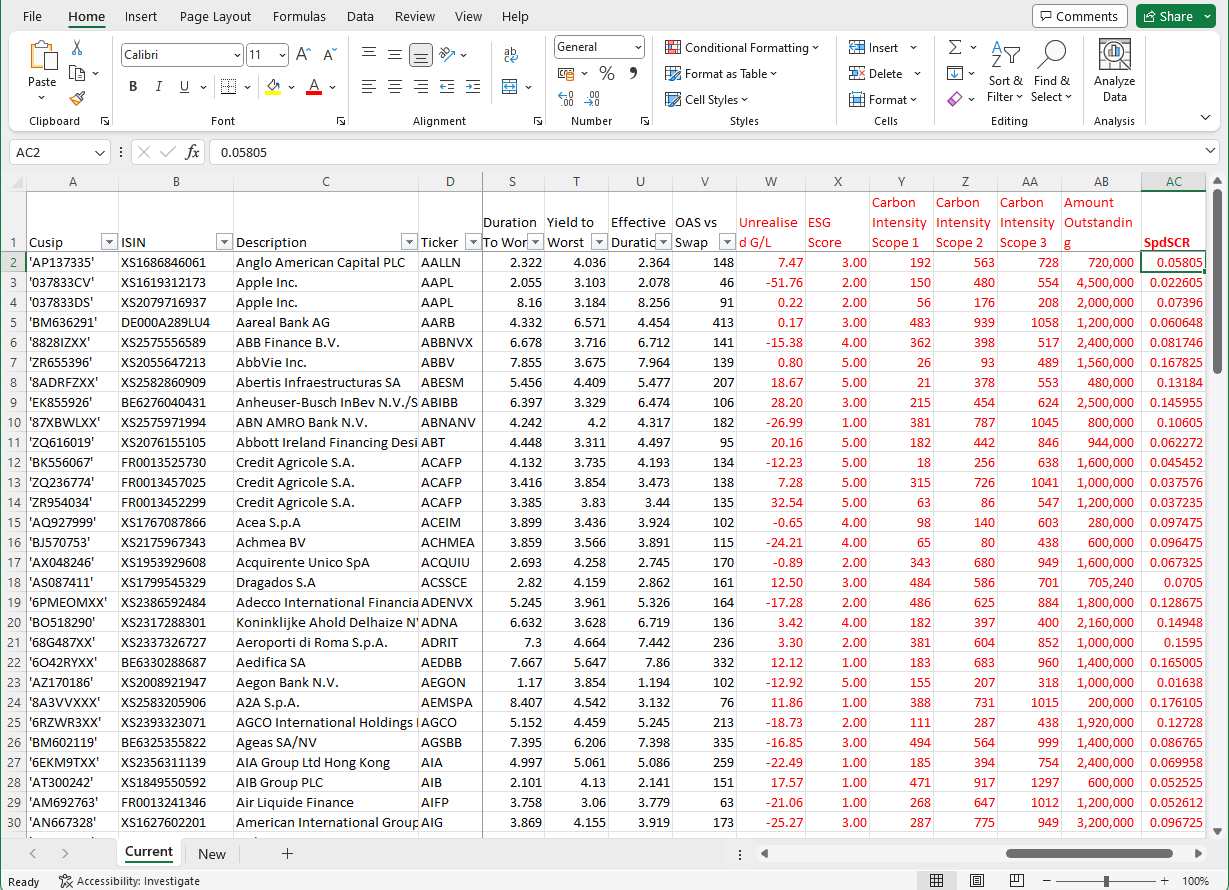

Modifying the Inputsheet

After calculating the SCR values, export the data and manually copy the SpdSCR columns into the 'Current' and 'New' tabs

of the Fixed Income Portfolio Optimiser inputsheet. You can download the modified spreadsheet below:

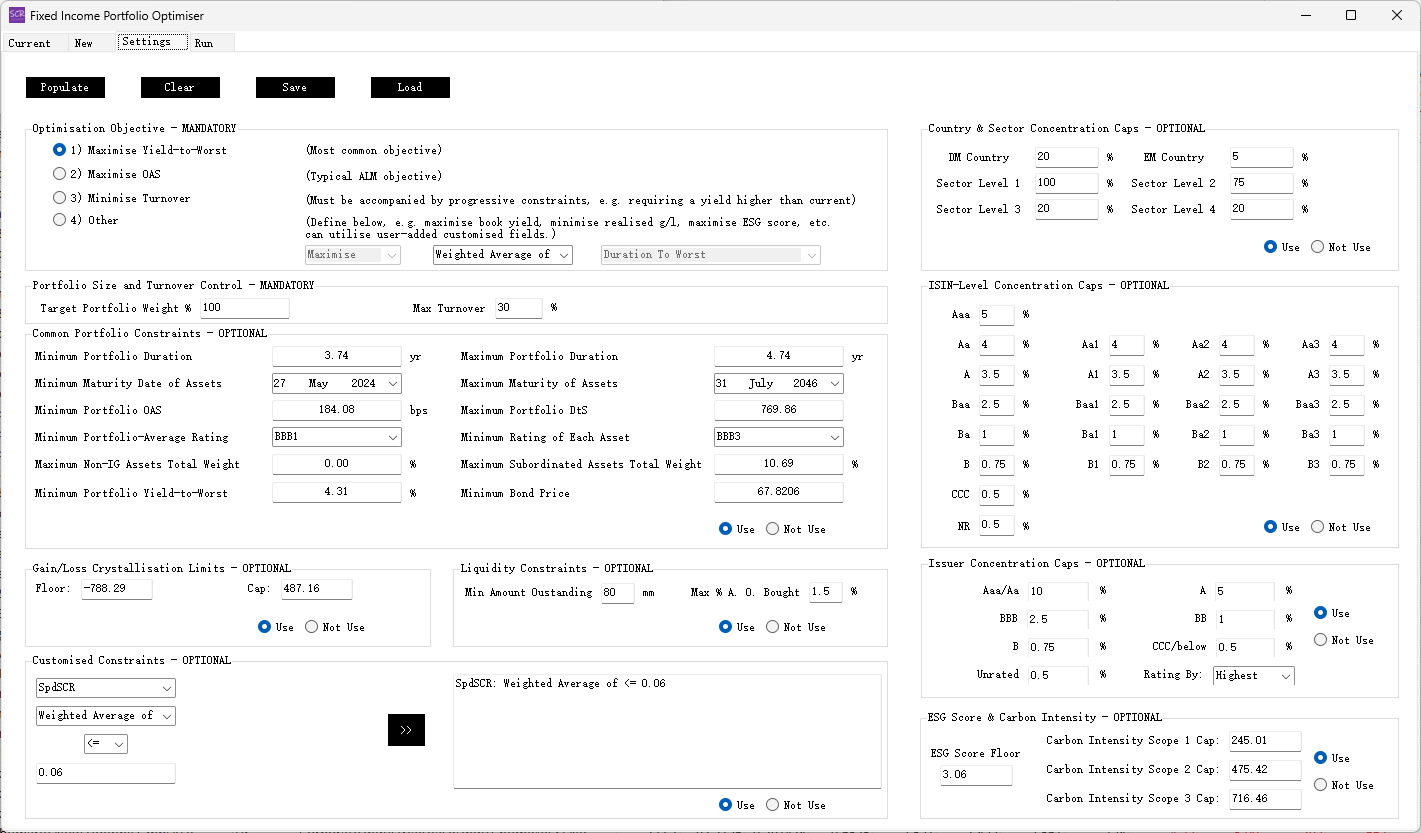

Setting SCR as a Constraint

Reimport the modified inputsheet into the Bond Optimiser.

In the 'Settings' tab, define a customised constraint for SCR, such as SCR <= 0.06 (the current value is 0.083).

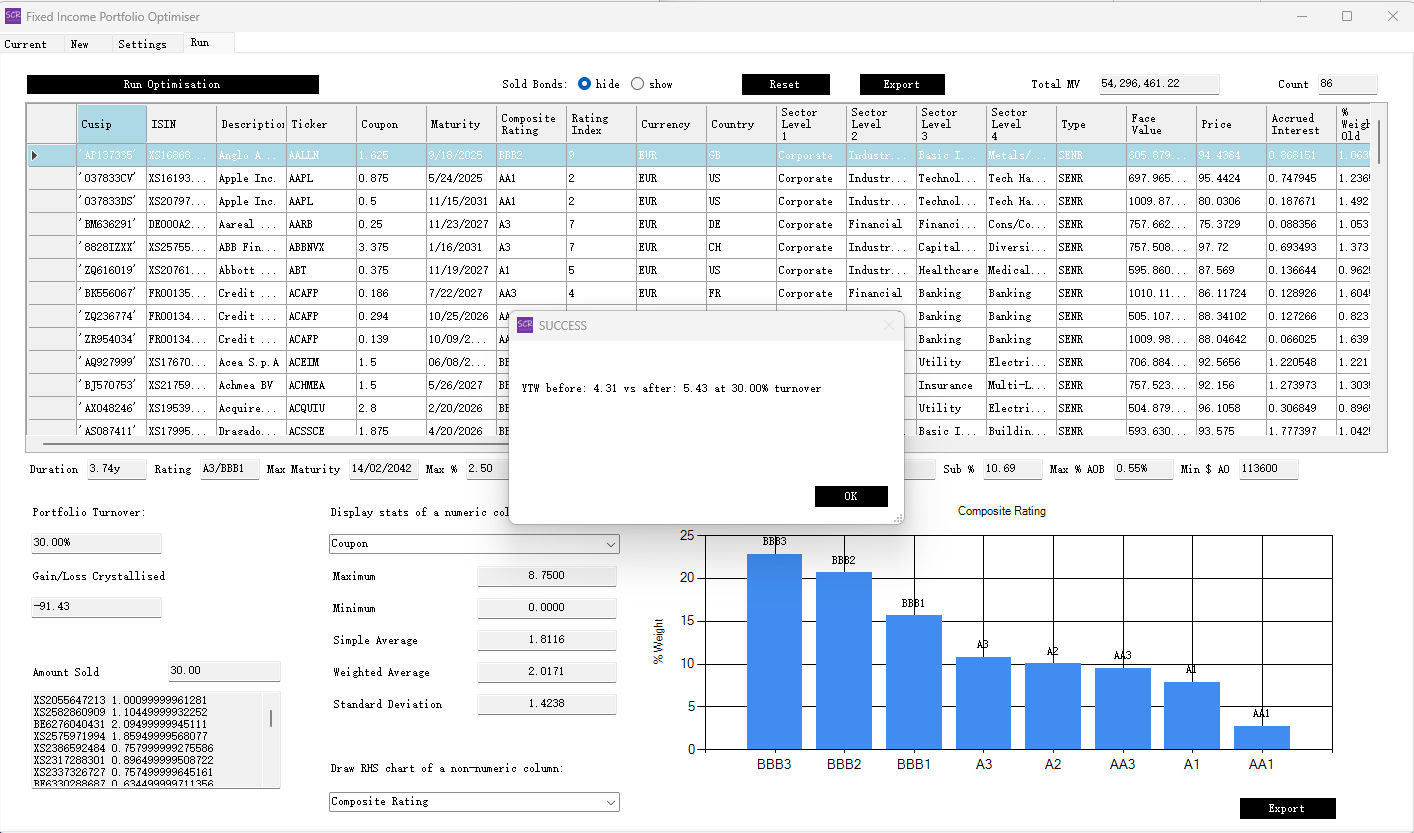

Optimisation Result

By applying the constraint, we achieved an increase in yield while simultaneously reducing SCR:

Users can choose different capital measures for inclusion in this process, tailoring the optimisation to specific requirements.