SCR Calculator User Manual

Version 1.17 Last modified 2025-4-6

Button and Datafields for Verification

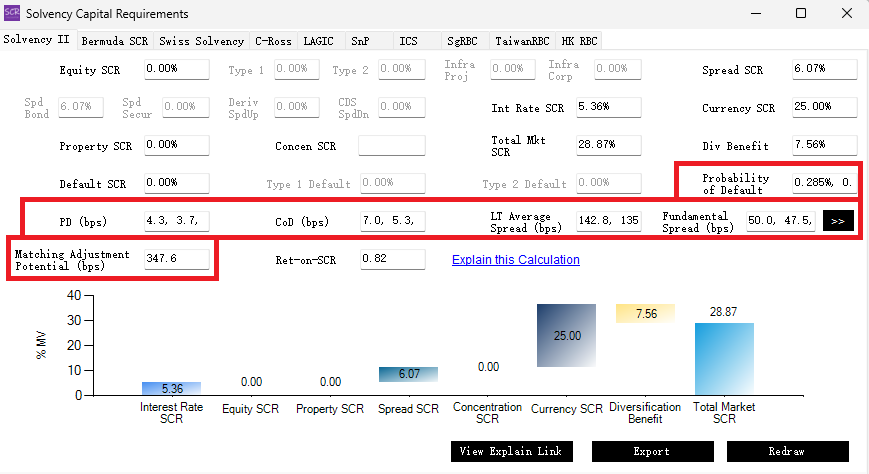

Verifying the Fundamental Spread CalculationAdditional MA-related data fields have been added to the Single Asset SCR panel:

Fundamental spread components—such as PD (as a probability and in bps), Cost of Downgrade in bps, and Long-Term Average Spread—are calibrated for each year over the bond’s life. The Matching Adjustment is calculated as the Z-spread minus the weighted average of fundamental spreads across all years.

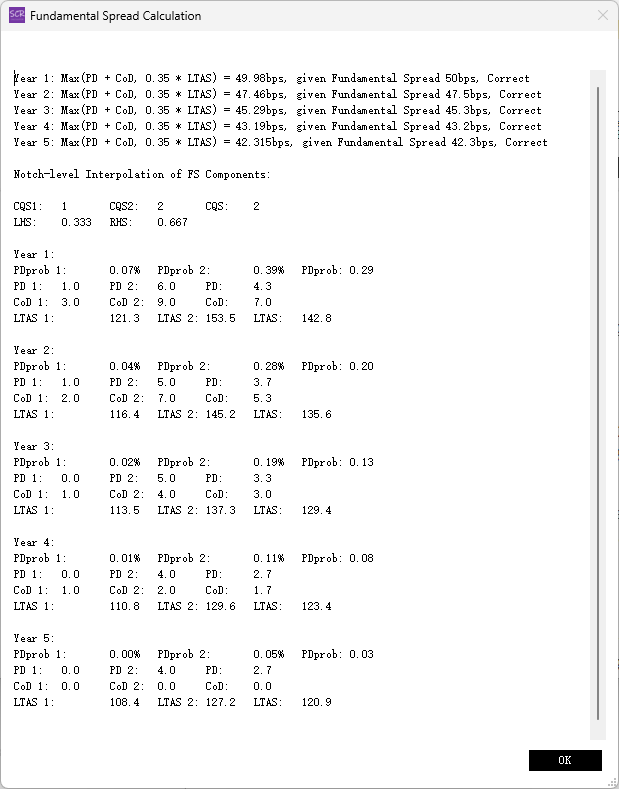

A verification button has been added next to the "Fundamental Spread" field. Clicking this button provides detailed verification of the fundamental spread calculation, as shown below:

The first section confirms that the calculated Fundamental Spread values for each year (based on the formulas described earlier) match the FS values published by EIOPA or the PRA within a margin of 0.5bps. (If users set their own FS component values, they must ensure those values also align with this standard.)

The "Notch-level interpolation of FS Components" section appears only when notch-level interpolation is applied. This section provides detailed data, including:

CQS1andCQS2: The two Credit Quality Steps (ratings) used for interpolation.CQS: The actual Credit Quality Step (rating) of the asset.LHSandRHS: The scaling factors.PDprob 1andPDprob 2: Probability of Default values as percentages used for interpolation.PDprob: The interpolated Probability of Default as a percentage (not used in FS calculation).PD 1andPD 2: Probability of Default values in bps used for interpolation.PD: The interpolated Probability of Default in bps (used in FS calculation).CoD 1andCoD 2: Cost of Downgrade values in bps used for interpolation.CoD: The interpolated Cost of Downgrade in bps (used in FS calculation).LTAS 1andLTAS 2: Long-Term Average Spread values in bps used for interpolation.LTAS: The interpolated Long-Term Average Spread in bps (used in FS calculation).

These data fields are also available in the Portfolio SCR form as exportable data columns, which will be explained in the next chapter.