SCR Calculator User Manual

Version 1.17 Last modified 2025-4-6

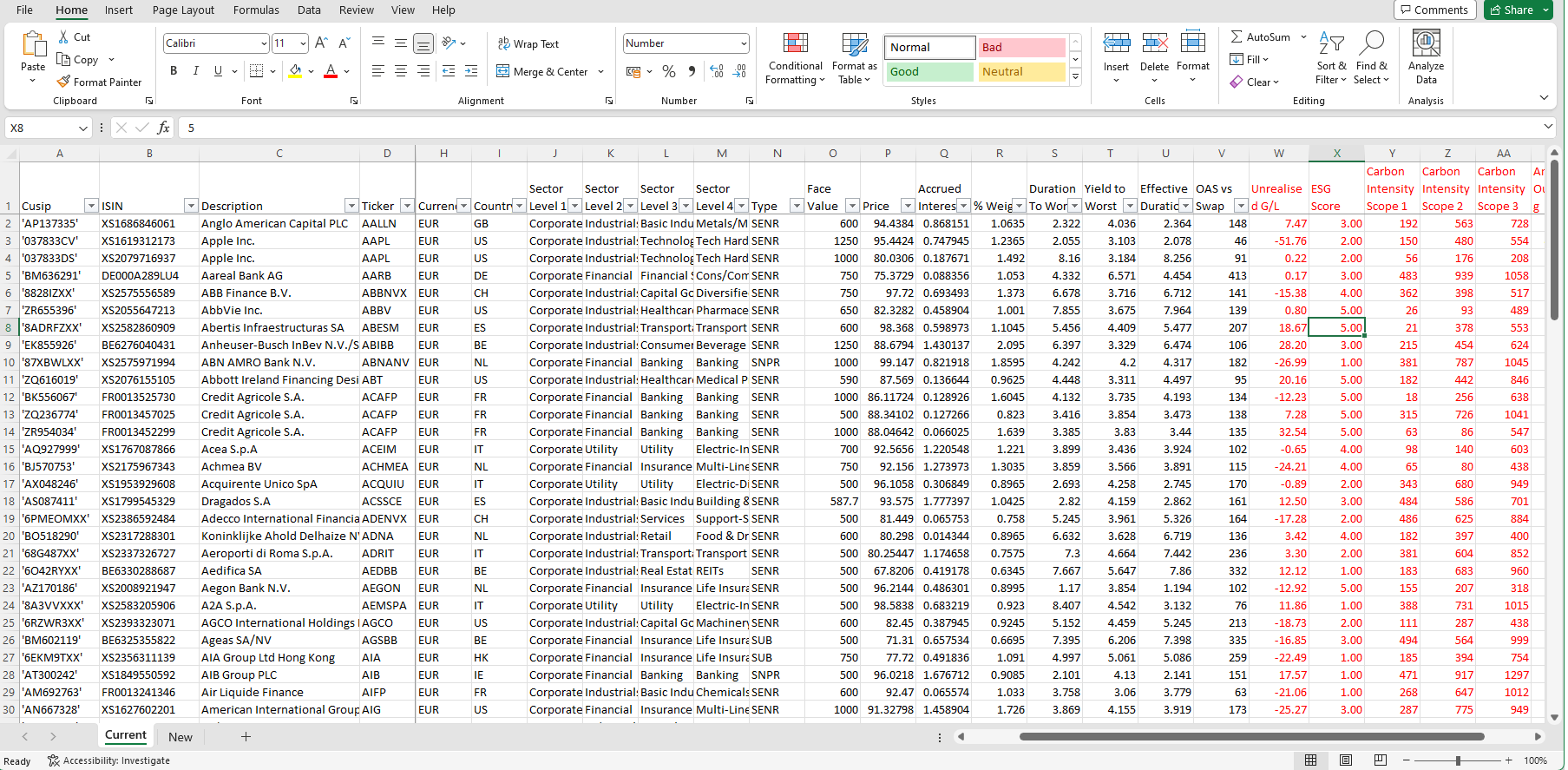

Inputsheet

The Fixed Income Portfolio Optimiser requires an input spreadsheet that adheres to the following structure:

- Two tabs: "Current" and "New" Both tabs must follow the same Bloomberg data fields layout. The "Current" tab contains line-level details of the existing portfolio (typically 100-200 bonds), while the "New" tab can represent an index universe with several thousand bonds.

- Mandatory Bloomberg data fields:

The following fields must be included:

Cusip,ISIN,Description,Ticker,Coupon,Maturity,Composite Rating,Currency,Country,Sector Level 1,Sector Level 2,Sector Level 3,Sector Level 4,Type,Face Value,Price,Accrued Interest,% Weight,Duration To Worst,Yield to Worst,Effective Duration,OAS vs Swap. Example input sheets include values for these columns. - Optional, non-Bloomberg data fields:

These may include

Unrealized G/L,ESG Score,Carbon Intensity Scope 1,Carbon Intensity Scope 2,Carbon Intensity Scope 3, andAmount Outstanding. While similar Bloomberg fields exist, the user must ensure these exact column names are used. Example input sheets provide dummy data for these optional columns, which are highlighted in red.

A downloadable example input spreadsheet is available below and is used throughout this section. You can also download this template within the software by navigating to Menu → Help → Download Demo Inputs. It serves as a template for building a new input sheet. Optional fields are marked in red.