SCR Calculator User Manual

Version 1.17 Last modified 2025-4-6

Mandatory Fields of the Bloomberg Inputsheet of the Portfolio SCR Form

A complete list of the required Bloomberg fields are: "Cusip", "ISIN" , "Ticker", "Coupon", "Maturity", "Composite Rating", "Currency", "Country", "Sector Level 1", "Sector Level 2", "Sector Level 3","Sector Level 4", "Type", "Face Value", "Price", "Accrued Interest", "% Weight", "Duration To Worst", "Yield to Worst", "Effective Duration", "OAS vs Swap".

The "% Weight" column can be edited by the user and should add up to 1 or 100. For other columns, you just need to ensure the Bloomberg data download is error-free.

If you add a 'CurrHR' column, and enter the numbers for each asset between 0 and 100 (or leave it blank if it is unhedged) it will work for a multi-currency, partially hedged portfolio.

How SCR Calculator Maps Bloomberg Barclays Asset Classification

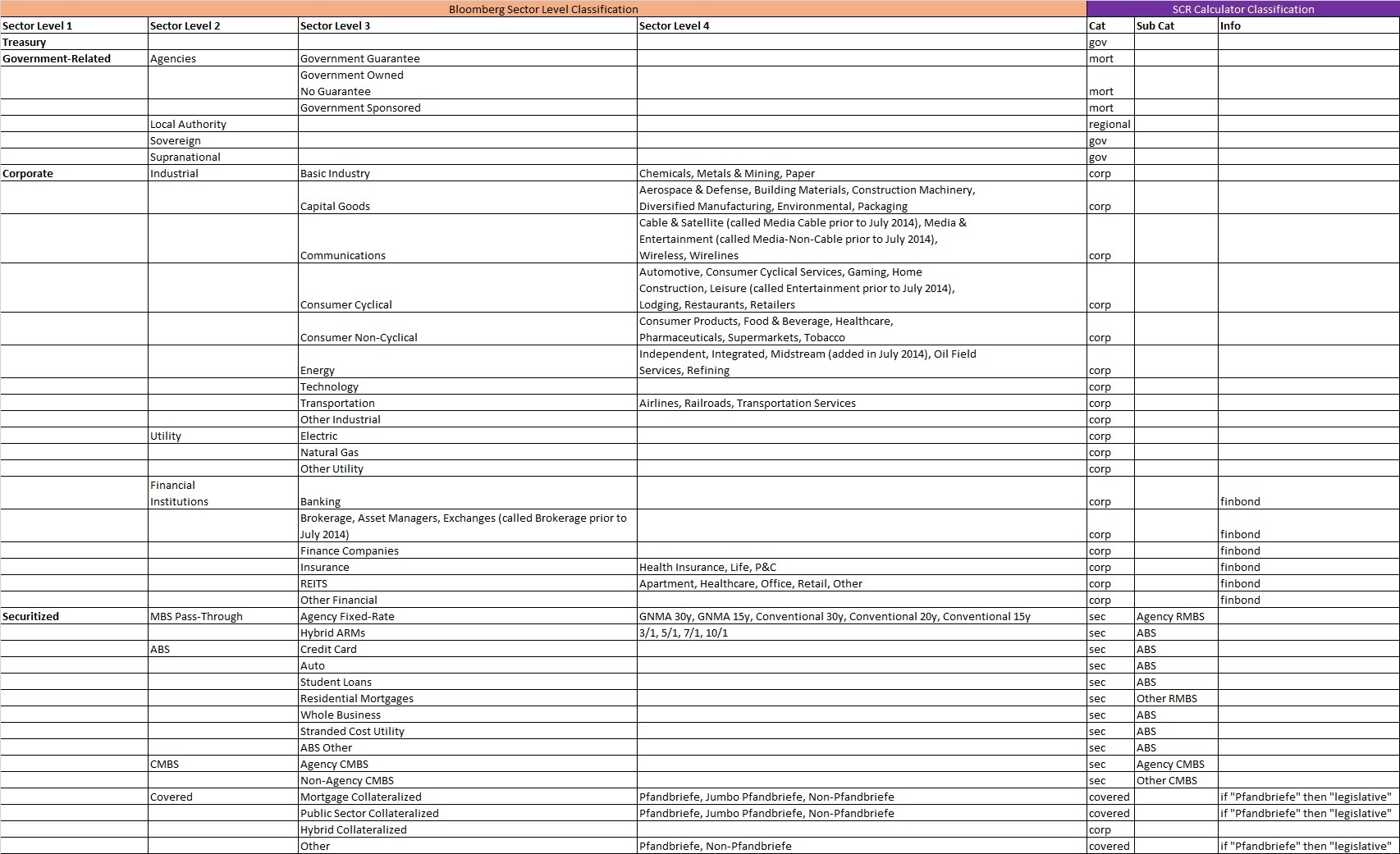

SCR Calculator reads the four Sector Level columns to derive a suitable asset type for SCR calculation. A complete mapping table is provided below:

- SCR Calculator uses this internal mapping mechanism to generate its own three columns "Cat", "Sub Cat", "Info" that guide its SCR calculation. These three columns are displayed in the data table area.

- If you provide the three columns "Cat", "Sub Cat", "Info" in the inputsheet, the SCR Calculator will accept these pre-populated values rather than generating its own.

Different Calculation Mechanisms

The explanations here are for your information and do not affect your usage of the calculator.

Compared with the Basic Inputsheet, there are some different calculation mechanisms using the Bloomberg Inputsheet, aimed at maintaining asset weight consistency between the two software:

- The Boomberg Inputsheet contains the "% Weight" column, and the SCR Calculator uses this column and the FX table to derive "MV_LC" values for each asset; while using the Basic Inputsheet, the FX conversion is the other way around - from local currency to portfolio currency.

- The Bloomberg Inputsheet contains Duration and Yield columns, and the SCR Calculator accepts these values rather than recalibrating its own.

- Because of the point above, when you investigate any single asset from a Bloomberg inputsheet back to the Single Instrument Panel, the yield and duration, and therefore SCR, will be recalibrated and will show a slight difference. There shouldn't be a large difference, otherwise the SCR Calculator's cashflow modelling is inconsistent with Bloomberg's and you should double check inputs and/or send us a query.