Release Notes

Last Updated: 2024-12-8

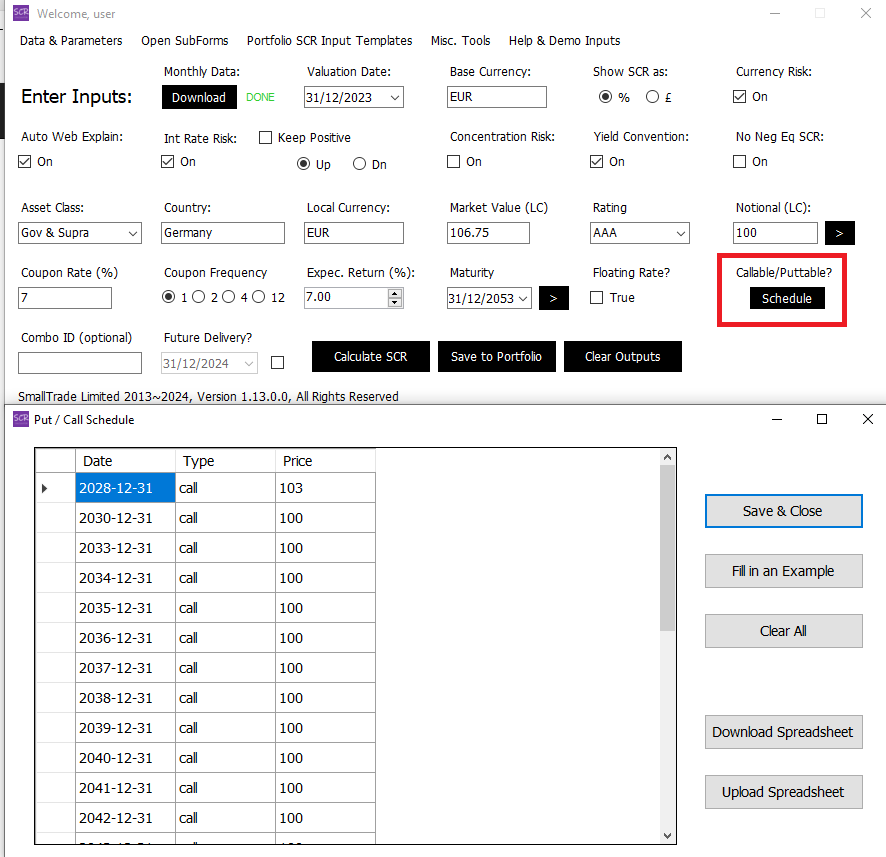

Call-Put Schedule

Spline Curve Extrapolation tools

22nd January 2024

Call-Put Schedule

Assets with multiple call/put dates and prices can now be modelled in the SCR Calculator:

- A "Callable/Puttable Schedule" button is added in the Single Asset Form (red box below), allowing the user to define as many calls/puts as needed during an asset's lifetime.

- The cashflows in the case of each call/put being used are projected and their present values compared against each other.

- Following a look-back algorithm inspired by the LICAT regime, the most likely option implementation scenario is determined and the corresponding cashflows used for solvency capital calculation.

- A "CallPutSchedule" column replaces the "Call Date" column in the Basic Inputsheet. This new data column is designed to contain complete information of all call/put dates and strike prices of each asset.

- More detailed explanations are in the updated Appendix II.1 Modelled Cashflows with Optionality

- This advanced function is only available in the desktop version of the SCR Calculator.

Spline Curve Extrapolation tools

A spline-based, batch curve extrapolation tool is added in "Misc Tools" in the main form: Algorithms include: Nelson-Siegal-Svensson, Linear Spline, Cubic Spline, Cubic Spline Natural, Akima Spline, Catmull-Rom Spline. Some of these are useful in regulatory curve generation processes.