Release Notes

Last Updated: 2024-12-8

17th October 2023

Hong Kong RBC; Bermuda Curves; Misc. Other Improvements

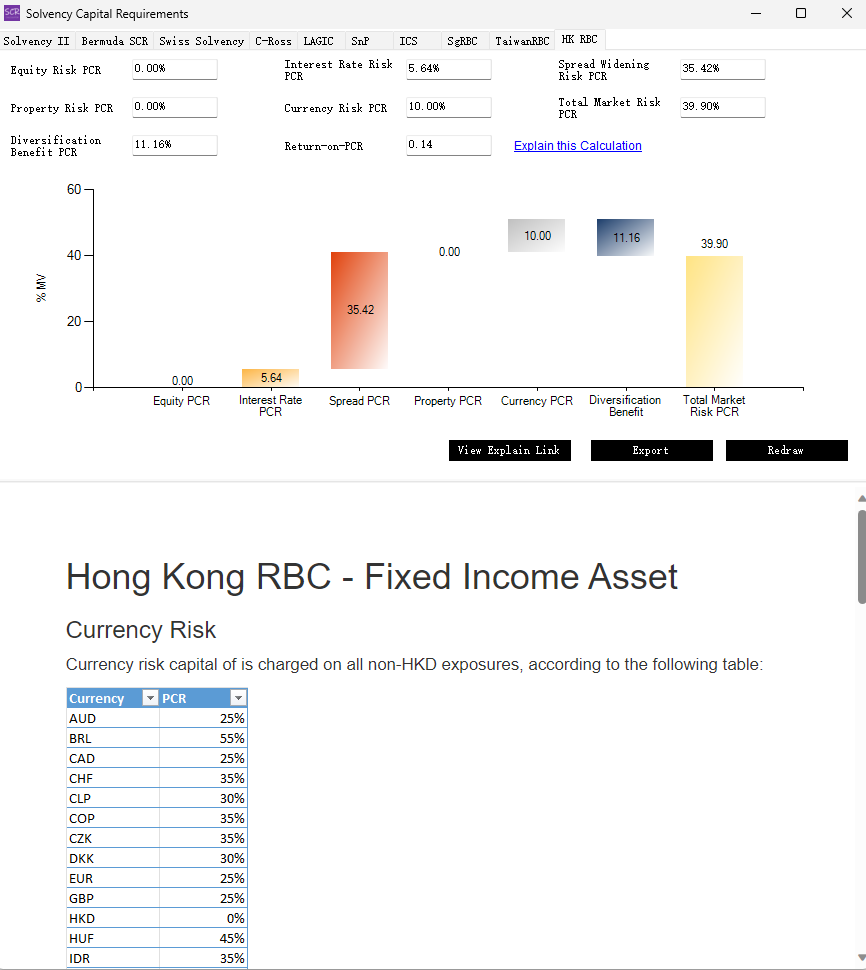

Hong Kong RBC (Early Adoption) is now implemented in the SCR Calculator.

ContextHong Kong RBC "is more Solvency II than Solvency II”, in the sense that it had similar timeline of QIS studies and delivered a more clearcut set of Prescribed Capital Requirement definitions with less “Specific Exposures” than Solvency II. It is almost the ideal shape for a hypothetical version of Solvency II. The stress-based spread PCR under HK RBC is also better than the tabulated spread SCR under Solvency II, in my opinion.

The Insurance Authority of Hong Kong is going to hold a public consultation in Q4/23, so the implementation is based on the Early Adoption version (many thanks for the friend who provided me with this!).

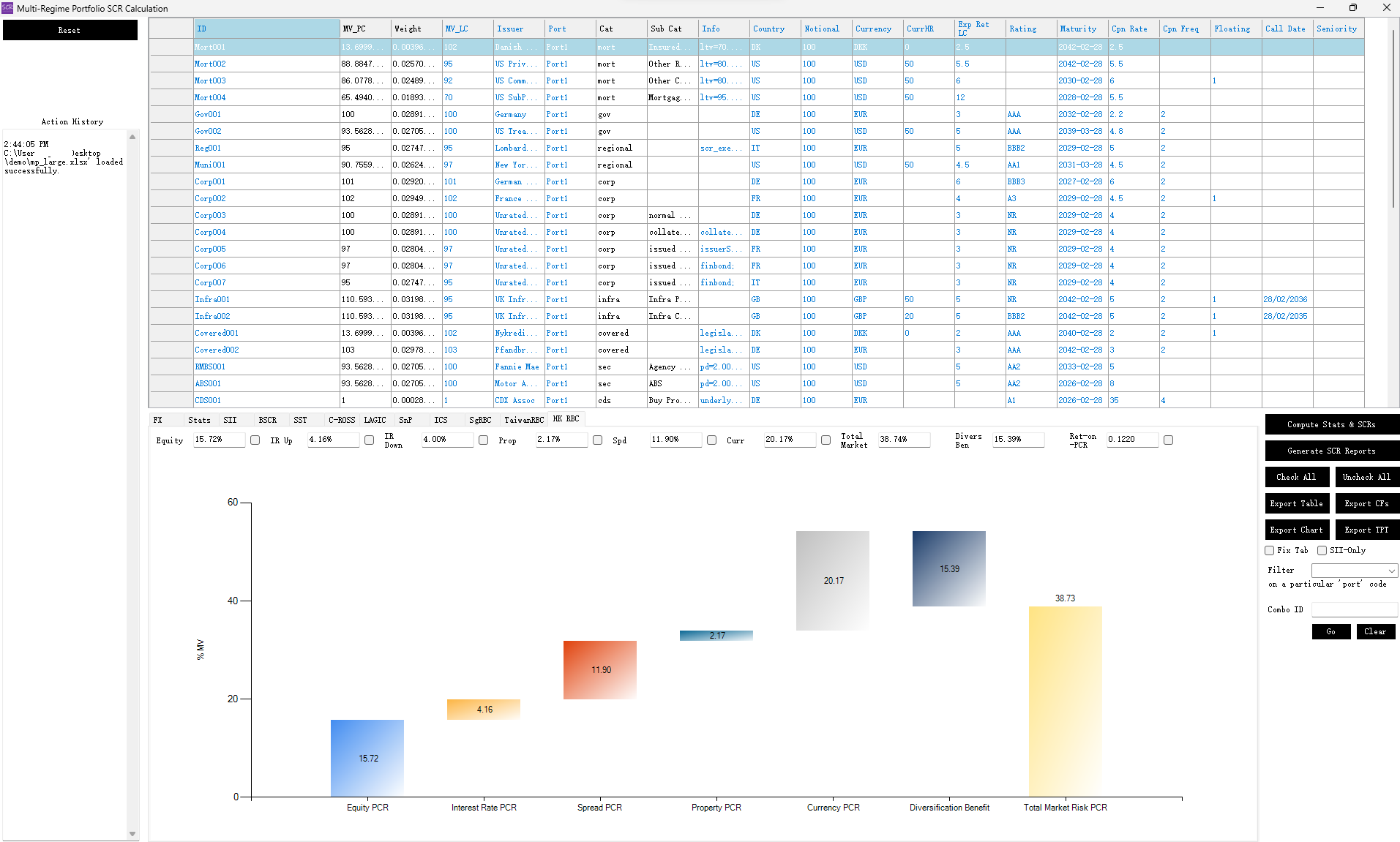

How to Use:Hong Kong RBC is one of the regulatory tabs in both Single Asset panel and Portfolio SCR Panel:

Single Asset Form

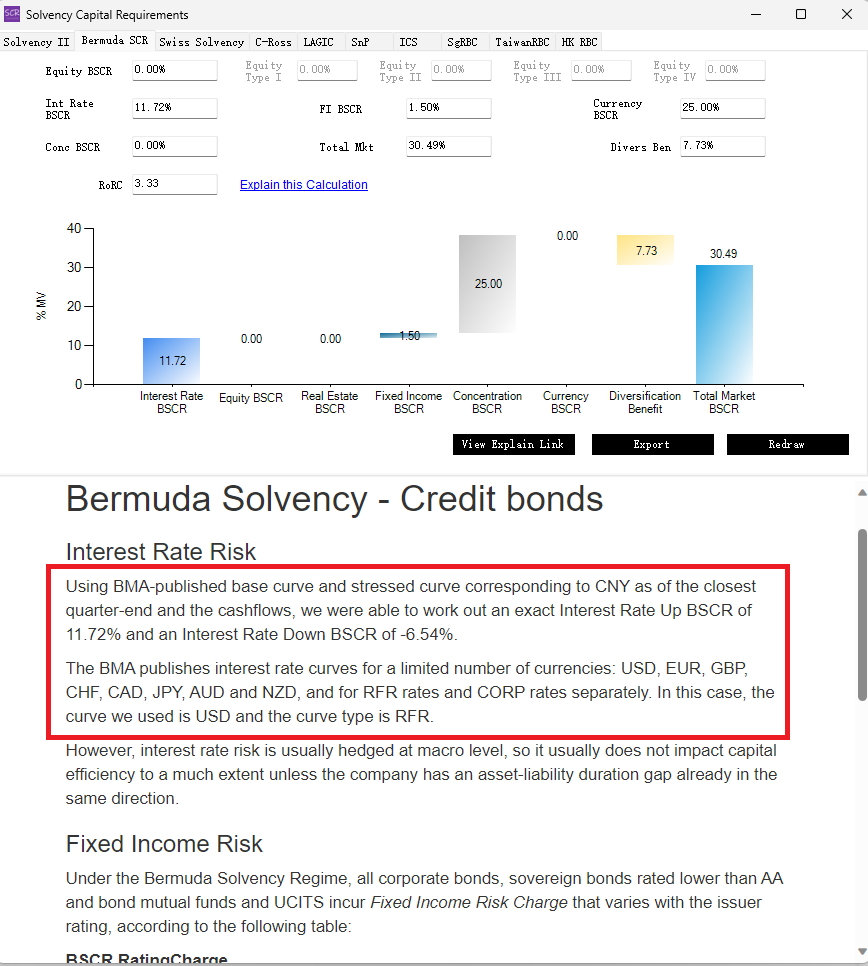

Bermuda Curves; and Curves charting in general

Now Bermuda quarterly official discount curves - risk-free and corporate curves - are in the SCR Calculator's database. When you calculate the BSCR, they will be used.

BSCR Int Rate Calcs

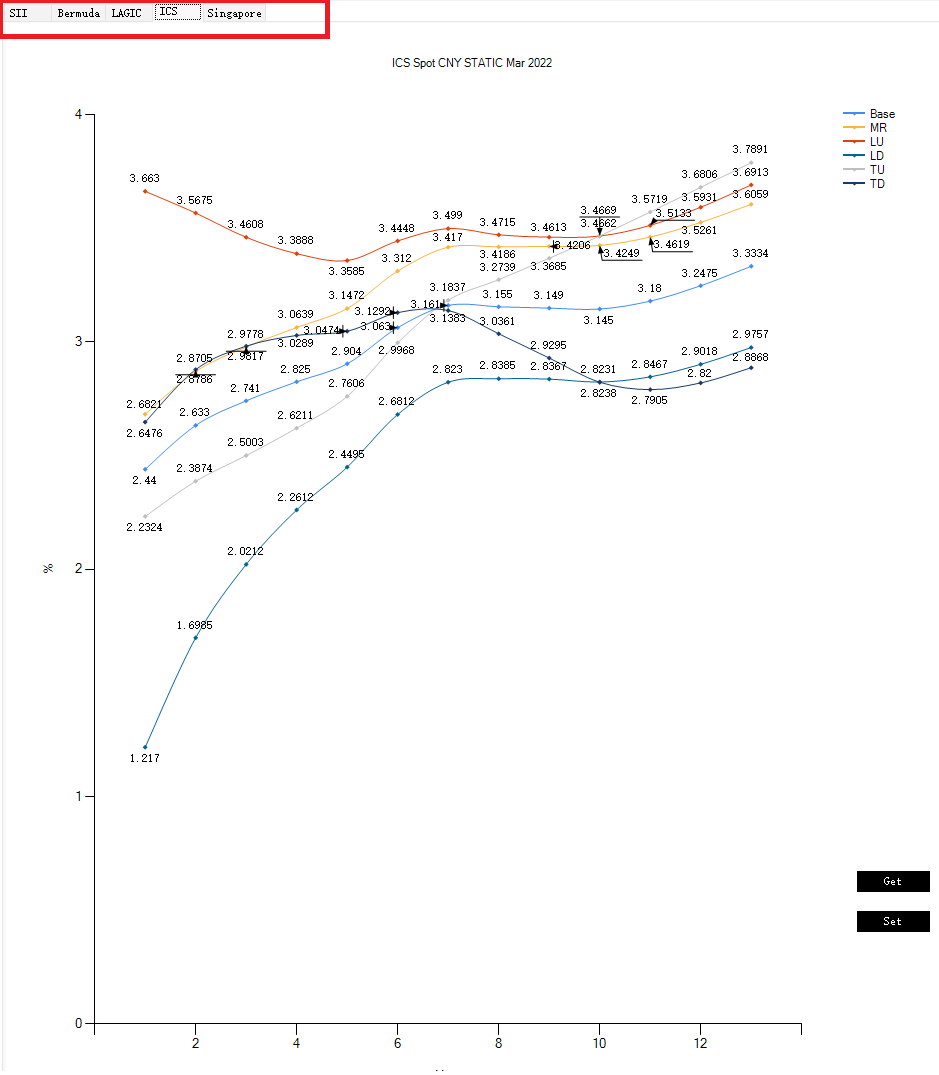

Presentation of the Different Regulatory Curves

Now the different sets of regulatory curves - EIOPA, Bermuda, LAGIC, ICS, Singapore RBC - are shown in separate tabs in the refined Cashflows & Sensitivities Form (Now called "Cashflows, Curves and Sensitivities"). You can observe the interesting differences between these curves. They are available for 'get/set' as well.