Release Notes

Last Updated: 2024-12-8

5th July 2023

Korean-ICS Added in v1.7.0

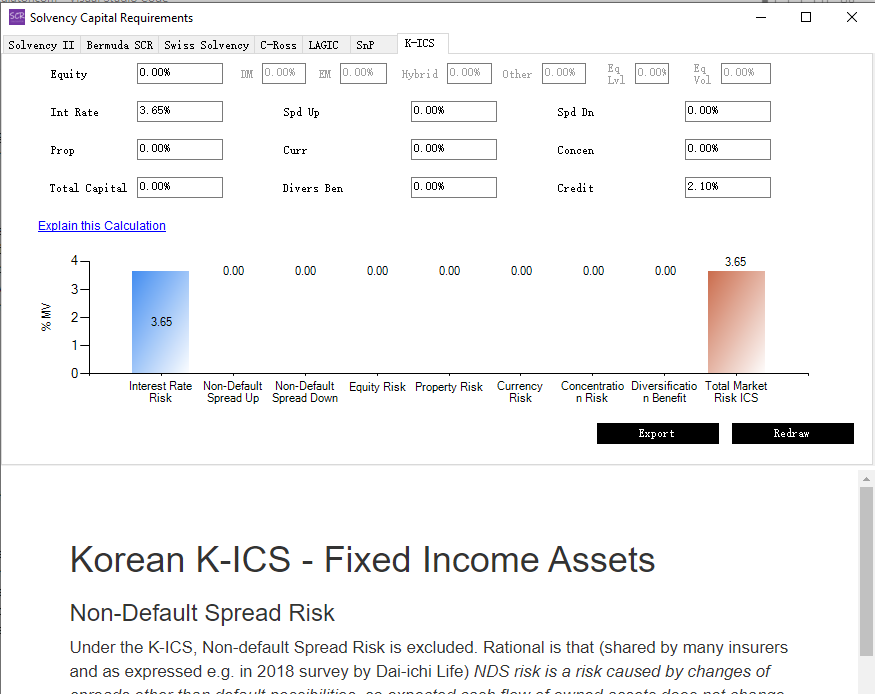

Korean-ICS (K-ICS) is now added in the SCR Calculator, in the form of a variation of the Insurance Capital Standard (ICS).

How to Use:From Menu, the user can select "Data & Parameters" → "Specific Parameters" → "ICS Regime Choice" → "K-ICS". This way, all the ICS calculations become Korean-ICS calculations.

Unique Characteristics of Korean-ICS as Compared to the ICSThe Korean-ICS regime has been implemented since beginning 2023 and closely resembles the ICS v2.0. The most notable difference is that the Non-Default Spread risk, an important element of the ICS, is not included.

In the 2018 survey, various insurers and industry groups opposed to the inclusion of this element, as well as its calculation method. For instance,

- "The impact of changes in spreads that are not as a result of default materializes only in the event that the entity is required to sell assets in the stressed spread environment. Since changes in non-default spreads are temporary in nature, the NDRS is in fact a liquidity risk that should be assessed elsewhere in ComFrame and not in ICS ..." (the Canadian IoA)

- "NDS risk is a risk caused by changes of spreads other than default possibilities, so expected cash flow of owned assets does not change when viewed on a going concern basis (buy and hold basis). Therefore, NDS risk is not a risk based on going concern, and it is unnecessary to be considered in ICS ..." (Dai-ichi Life)

- "The calibration of credit default, migration and spread risks should be considered together and consistently with the underlying valuation approach. There is a highly conservative calibration of credit default risk which is combined with a suitable application ratio for spread risk, leading to a reasonably conservative total requirement. However, given the lack of a consistent methodology there is a high risk of overlaps and double-counting of risks in combined credit risk charges ..." (Allianz)

Other differences include:

- MOCE (Margin-Over-Current-Estimate): the Percentile approach is used as per the ICS but with different ratios for life and non-life businesses.

- Similar to the transitional arrangements under Solvency II, a 20-year grace period is in place for the K-ICS.

- Korean government and regional bonds are exempt from credit risk.

- The Three bucket approach is used for deriving the risk-free discount curves for liabilities of different natures, but there is a simplification towards the matching adjustment and volatility adjustment approach rather than the full approach.

- Infrastructure equity receive SII-like favourable capital relief.

- Private Equity and Hedge Funds with leverage will be charged extra capital based on their leverage ratios.

- Asset concentration risk is based on a simplified, Korean-rating-based method rather than the full ICS method.

- Equity and Real Estate market risk correlations are set as 25%, as opposed to the 50% in the ICS.

The above points, where relevant, are all reflected in the SCR Calculator's implementation.

Misc Improvements and Bug Fixes

- Moved the verbal explanations to be inside the App rather than opened in a separate browser.

- In 'Import Allocation' and 'Import TRS' steps, added auto-pressing of the One-Click SCR and the EF calibration buttons, to improve user experience.

- Fixed the correlation matrix misalignment issue in the EF form.

- ICS non-property and property concentration risk parts are square summed instead of simple summed.

Below is an example screenshot using the SCR Calculator to calculate K-ICS asset charges: