Release Notes

Last Updated: 2024-12-8

2nd October 2023

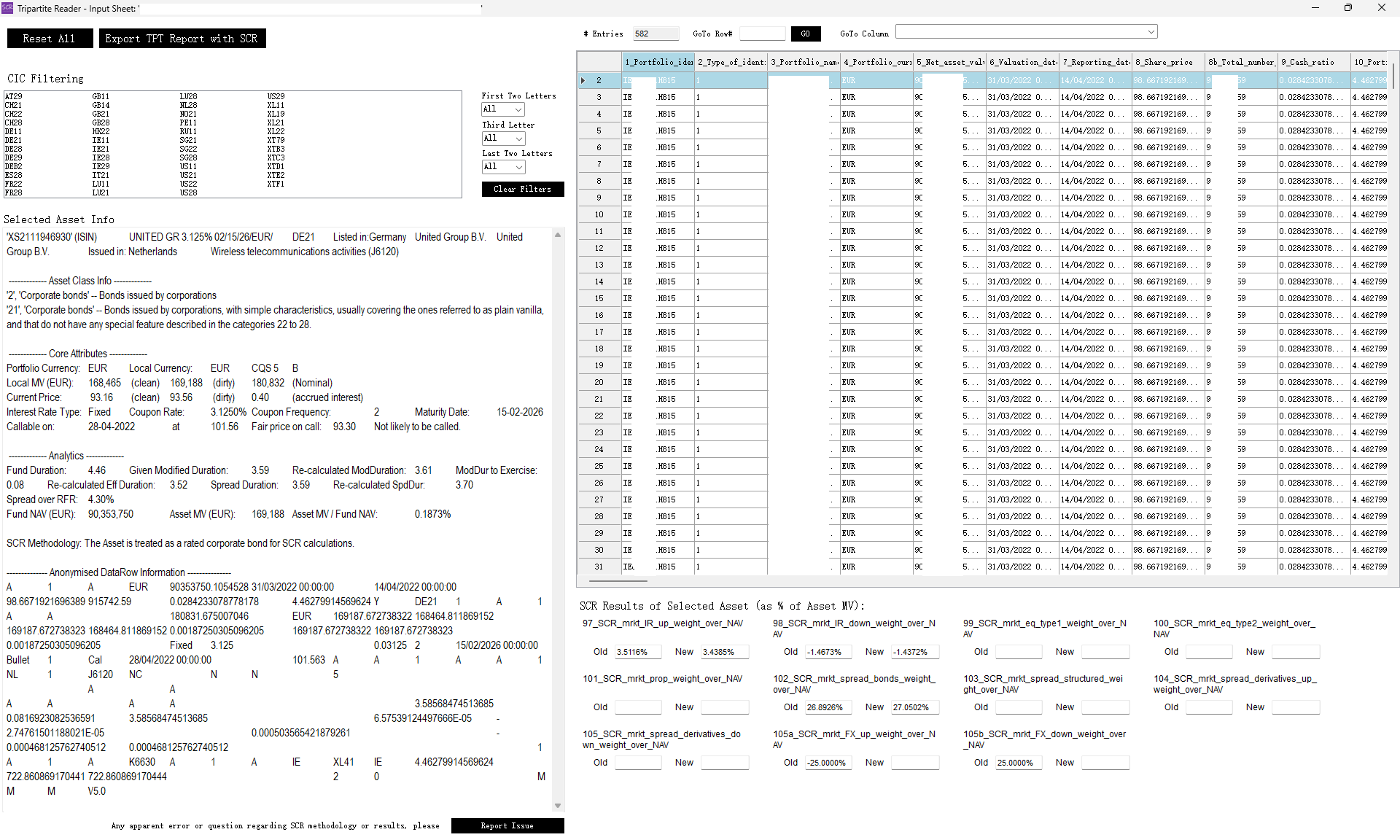

Tripartite Reader

The Tripartite Reader is a smart tool for facilitating mandate and fund reporting by asset managers to insurance company investors. It is now added as a module in the SCR Calculator.

ContextThe Tripartite Report is a standard template advocated by FinDatEx and widely used by European asset managers to report asset holdings to their insurance clients, so that insurance companies can easily fit the data into their own quantitative reporting templates. There is an option whether to provide asset data only, or to also provide calculated Standard Formula SCRs for those assets. Obviously, managers who can report SCRs will be seen as more competitive, but there is usually a marginal cost involved when handled externally/manually.

Now the Tripartite Reader within the SCR Calculator can produce all the 11 required SCR columns for an arbitrary Tripartite report, at zero marginal cost!

- "97_SCR_mrkt_IR_up_weight_over_NAV"

- "98_SCR_mrkt_IR_down_weight_over_NAV"

- "99_SCR_mrkt_eq_type1_weight_over_NAV"

- "100_SCR_mrkt_eq_type2_weight_over_NAV"

- "101_SCR_mrkt_prop_weight_over_NAV"

- "102_SCR_mrkt_spread_bonds_weight_over_NAV"

- "103_SCR_mrkt_spread_structured_weight_over_NAV"

- "104_SCR_mrkt_spread_derivatives_up_weight_over_NAV"

- "105_SCR_mrkt_spread_derivatives_down_weight_over_NAV"

- "105a_SCR_mrkt_FX_up_weight_over_NAV"

- "105b_SCR_mrkt_FX_down_weight_over_NAV"

Besides, it can also:

- summarise information - organise the asset row information in a human-friendly format in an output box.

- compare with previous SCRs - if there are older SCR calculations.

- provide opinion - e.g. where there is a call date, it can judge whether the bond is likely to be called and calculate the SCR accordingly.

- provide context- for each Tripartite column, reference the definition, required data format and relevant CIC codes.

More asset classes are now implemented in the SCR Calculator:

- Bond Futures / Interest Rate Futures

- Interest Rate Swaps - as a "Combo Asset"

- Convertible Bonds - as a "Combo Asset"

A "callable" judgement function is added in the Single Asset SCR panel. It calculates the "fair value" of a bond on the call date, based on an assumed spread on that day, and advises the user whether the bond is likely to be called, helping with the cashflow projection and SCR calculation.

The asymmetric effect of callability and price ceiling on interest rate and spread curve stresses are now allowed for in the modelling.

An "auto web explain" box is added in the Single Asset SCR panel, so that the user can stop any asset info from being sent to the 'Explain this Calculation' API.

EIOPA data download are now auto-cached, so the user won't have to download the same day's data twice.