Release Notes

Last Updated: 2024-12-8

23rd October 2023

Annuity Cashflow Matching

Previously the Fixed Income Portfolio Optimiser was only designed to provide one-off transactional cashflows. Now it is updated and suitable for constructing and rebalancing a long-duration cashflow-matched annuity-backing bond portfolio. The cashflows can be de-risked using EIOPA or PRA data and the matching adjustment potential can be maximised. This is suitable for a number of occasions, e.g. Bulk Purchase Annuity portfolio design.

The steps of implementing long-duration cashflow matching are:

- User prepares a series of best estimate liability cashflows many years into the future, and set a close range for matching.

- User puts bond assets (both current assets and investible assets) through the Portfolio SCR form so the Matching Adjustment potential and Probability of Default time series for these assets are obtained.

- User puts these bond assets with those extra information into the Fixed Income Portfolio Optimiser, and generate cashflows on de-risked basis.

- The FI Portfolio Optimiser searches within a target end weight range (e.g., 60% to 120%) compared to the current portfolio; and identifies a minimal-sized optimised portfolio that can deliver all the liability cashflows required, while also maximising the de-risked-cashflow-PV-weighted Matching Adjustment potential.

- All important metrics of the asset portfolio can be targeted if it is a new portfolio construction case, or maintained if it is a portfolio rebalancing case.

Matching Adjustment More Granular

Previously the Matching Adjustment for a bond was calculating by subtracting a single Fundamental Spread value from its Z-spread over the Risk-Free-Rate. Now the fundamental spread is calibrated for every year up to the life of a bond; and Matching Adjustment is computed as Z-spread less the weighted average of fundamental spreads for all years of the bond's life.

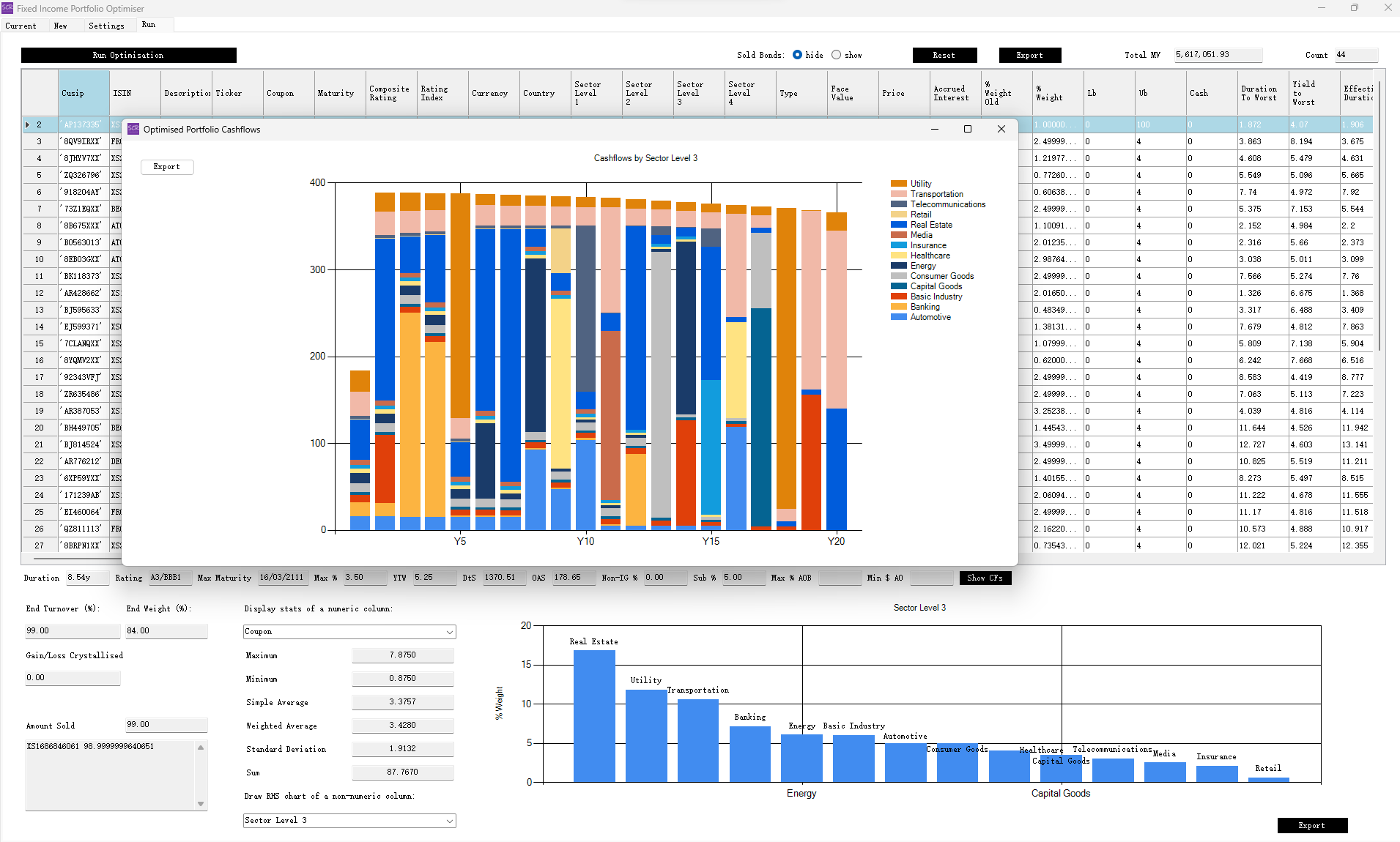

Improved Cashflow Presentation

User can observe cashflows by arbitrary composition metric for 'Current', 'New' and 'Optimised' portfolios. Below is a screenshot of well-matched cashflows by Sector Level 3 of Bloomberg.

For more details on how these refined functionalities can be used, see User Manual updated sections:

- Chapter III 'Matching Adjustment' Section 4 'Buttons for Verification'

- Chapter IV 'Portfolio SCR' Section 6 'SCR Tabs'

- Chapter VII 'FI Portfolio Optimiser' Section 5 'Settings' and Section 13 'Annuity Cashflow Matching'.